Lucky 13th Edition: Card Market Outlook and Some Nonsense Chatter with Bobby Witt Jr.

Sponsored by SGC Cards gosgc.com

Last week, Mike faced the inevitable: Brady’s retirement. We provided some thoughts on value in the Brady market, as well as how the Super Bowl-bound Bengals and Rams card prices have been affected. We also spoke with Chris McGill of Card Ladder about the state of the card market and his thoughts going forward. This was a great conversation that you don’t want to miss.

New Nonsense

In case you haven't seen all 10,000 other headlines covering it, the GOAT is retiring. This hit Mike pretty hard, but he believes the announcement will kickstart some growth in the TB12 market leading up to his Hall of Fame induction before becoming a gradual, "401k-type" investment. We can confirm, though Mike's love for Brady may hurt his desire to watch sports, the "show will go on" as they say and SCN won't be cancelled.

But it wasn't all heart ache this week. Chris McGill, the CEO of Card Ladder, came on the show to talk about what is up with Card Ladder and how the market looks so far this year. Chris provides some insider analytics, including the 16% market bump for football over the last month, and explains the total market index features in the app (as used in the infamous Luber Manifesto). Chris also has some exciting news to share as they continue to grow and develop new features for Card Ladder.

This week was BIG on Video Nonsense. Bobby Witt Jr. joins the show to open a box of Mosaic football, which we are giving away! Make sure you check out the show here for details.

Mike and Jesse spotlight some cards available through Goldin Auctions, including a very rare 1933 Goudey Babe Ruth autographed card and some Marvel Precious Metal Gems, which are gaining ground in the hobby. As Jesse mentioned in the show, “it is awesome because, essentially, Marvel is only growing. They just set a new record recently, there was a page, a PAGE of a comic book that did like $3 million at auction.”

Hit us up on Instagram with your take.

“Need More Nonsense?”

https://sports.yahoo.com/york-jets-hilarious-reaction-tom-163154563.html

After conflicting reports this week, TB12 has confirmed he is

hanging them up. Nobody had a better reaction to the news than his old AFC East rival New York Jets.

Jesse reported tennis cards are up in value according to eBay last week. The trend is evident as PWCC Marketplace sold a pair of Serena Williams cards for record numbers, including $117,000 for a PSA 10 example of her 1999 Sports Illustrated Kids card. This is the highest sale of a female athlete card ever.

BGS vs. PSA vs. SGC Ultra-Modern Basketball Revisited

John Dudley

Recently on the podcast Mike and Jesse broke down how SGC was starting to separate itself from BGS as the number 2 grading company. This is a topic that is near and dear to this space and one that always makes my ears perk up. While Mike Gio’s assertion is consistent with the findings and general advice of this column, the guys noted that ultra-modern basketball marks the ultimate test for SGC as it represents the hardest era and hardest sport for SGC. Even though this space has seen a nine-part series comparing SGC and PSA pricing, BGS hasn’t always been included. The initial inquiry into ultra-modern basketball prices didn’t include enough observations and frankly didn’t investigate BGS pricing close enough to see if SGC truly passes the test that ultra-modern basketball presents. This week’s article aims to fix this by re-examining graded card prices in the ultra-modern basketball market using substantially more data than before.

In order to compare pricing amongst the grading companies, a series of transaction matching is used where sales are included in the database if they have a PSA 10, SGC 10, and BGS 9.5 sale all within a day or two of each other. Sales are only included if they have sales from all three companies and multiple sales require multiple separate counterparts. BGS is different from PSA and SGC in that they include subgrades. Previously, we’ve seen that BGS 9.5s with all four subgrades scoring 9.5 and up carry a premium over 9.5s without quad-9.5 subgrades. Consequently, sales have been separated into groups with those with a BGS 9.5 with all 9.5 and higher subgrades and those without those lofty subgrades. By restricting inclusion in this way, it is hoped that we capture more of the difference in pricing based on grading and less of random market fluctuations. The cards included were: 2018 Luka Doncic Prizm 280, RC 2018 Trae Young Prizm 78 RC, 2019 Zion Williamson Prizm 248 RC, 2019 Ja Morant Prizm 249 RC, and 2020 LaMelo Ball Prizm 278 RC.

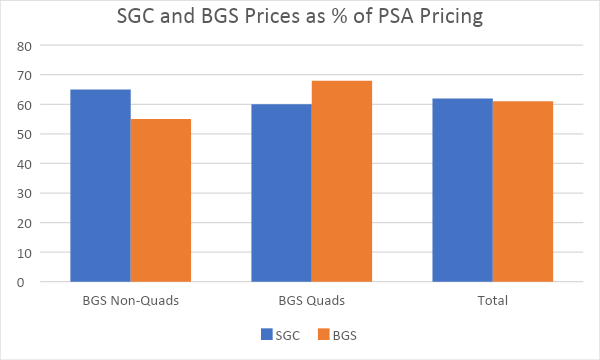

Table 1: SGC and BGS Prices as a % of PSA Pricing

The results are shown in Table 1. Overall, SGC and BGS sales were just about identical coming in at approximately 62% of PSA sales value with a slight edge to SGC. The 62% figure is close to the 65% figure found in it the initial article. This is important as prices seem to have settled in at the 60-65% range which was not a sure thing when the last article was written as that figure represented a narrowing of the gap between PSA and SGC sales. While the gap has not narrowed more, it has resisted reverting back to a wider state. The numbers for BGS splits as expected with non-quad 9.5s fetching 55% of PSA value and quads fetching a more respectable 68%. On average BGS and SGC are selling for similar prices, but on any given card the BGS sale depends on those crucial subgrades.

These results can be useful for making decisions about where to send cards off to get graded. It would be easy to look at the results and to decide to just ship everything off to PSA. After all, PSA clearly gets the highest prices. This ignores the costs associated with grading, both financial and temporal though. Currently, SGC has their lowest service at $23.00 (through the highly suggested Nash cards) compared to $100.00 for the non-restricted PSA service ($50.00 is still limited at time of writing). At those prices, one needs to expect grading to increase the value of a card approximately $200.00 or more to come out ahead financially with PSA and that’s not even taking time into account.

If SGC and BGS cards sell for close to the same amount, can we really say that SGC is making headway as the number two grading company? Absolutely. SGC just dropped prices again and now offers a turnaround time of 1-2 months for $23.00 a card. BGS currently is restricting orders and working on a backlog estimated to still be over a year long and costs a staggering $125.00 a card. Even with the price bump for BGS 9.5s with quad subgrades, the grading costs make it difficult to see any instance where one would not choose SGC (cheaper cards) or PSA (higher end cards) given the wait times and grading costs at BGS. In a magical world where costs are equal, SGC still gets an edge over BGS as 9.5s come back without quad 9.5 subgrades frequently. Outside of personal preference (BGS does have nice holders), the only real reason to use BGS is to hunt down Black Label cards and they are rare enough that rational collectors should not really factor them in when deciding where to send cards off to. SGC shows itself the clear winner in the battle with BGS for reasonable PSA alternative in the incredibly finicky ultra-modern basketball market.

Be sure to check out next week’s issue for the start of a new segment where conventional hobby wisdom is put to the test.

Thank you for writing this and sending it out in an email. I really enjoyed getting this and reading it this morning.